Answers to 5 Important Questions About Incapacity Planning

What you need to know about planning for incapacity

Q: What does "disabled" mean?

A: In the estate planning world, the term “disabled” refers to an individual’s incapacity or the inability to manage day-to-day financial and legal affairs such as managing and protecting assets, signing documents, paying bills, and filing taxes. “Disability” or “incapacity” doesn’t mean you’re stuck on the couch with a bad back - it means that you don’t have the physical and mental capacity necessary to manage your personal affairs.

Q: How can I be sure to stay in control of what happens to my property if I become disabled?

A: There are two options for maintaining control during a period of disability; and, often, we recommend the use of both: power of attorney and revocable living trust.

Q: How do I avoid being kept alive by machines if I'm brain dead?

A: A living will is used to convey your directive about the use of extraordinary life sustaining measures such as life support at the end of life.

Q: Who will make healthcare decisions for me if I can't make those decisions myself?

A: Your agent under your health care power of attorney has the power to make healthcare decisions for you if you are unable to make those decisions yourself.

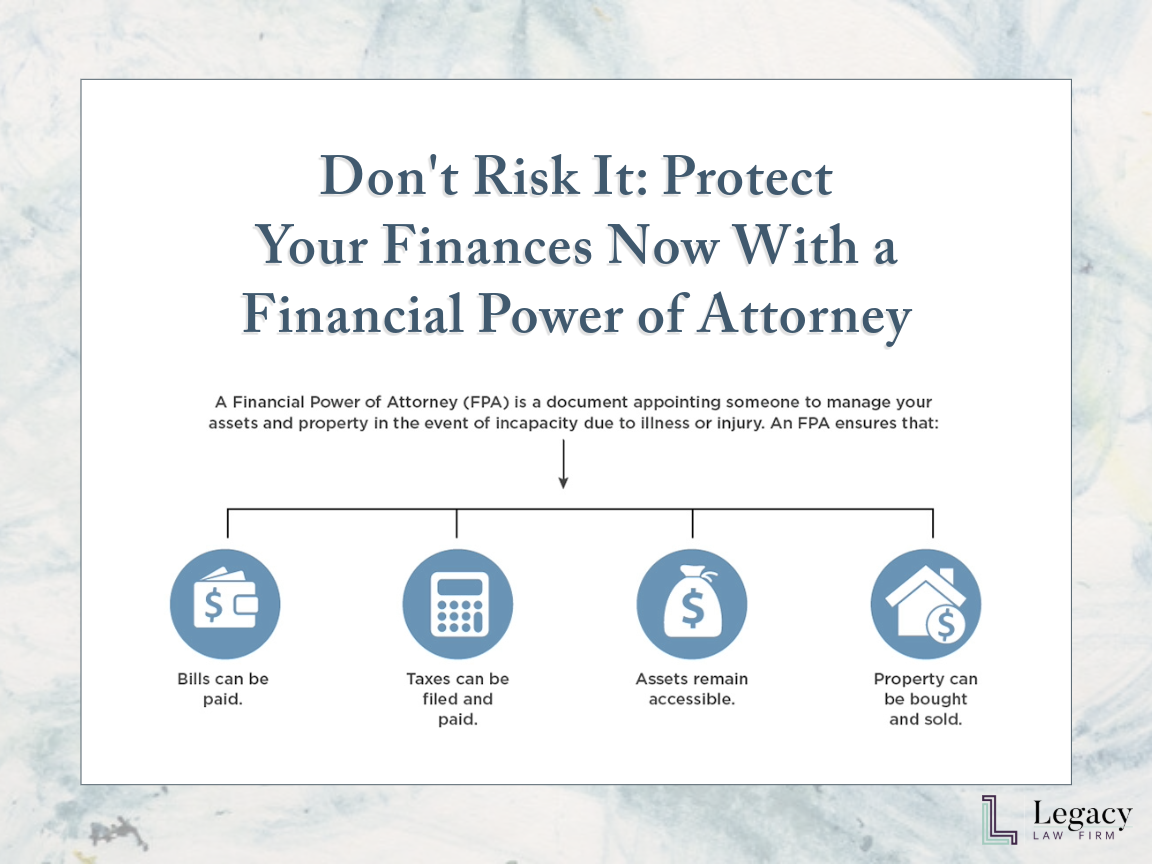

Q: Who will take care of my finances if I become disabled?

A: Potential disability is the perfect example of why you need to appoint trustworthy and reliable fiduciaries. If you have a well drafted power of attorney, the named agent will be able to manage your finances, including paying your bills. Unfortunately, if you don’t include incapacity planning in your estate plan, your loved ones will have to battle it out in court and the court will decide who should be your guardian and make decisions for you.

It is important to remember that the court doesn’t always appoint the person who you would want to make decisions for you. This is exactly what happened to Britney Spears when her father was appointed as her Conservator, and she had to spend years trying to convince the court that he was not the person who should be making decisions on her behalf.

Legacy Law Firm is here to help you maintain control over your life

Don’t be like Britney. Contact Legacy Law Firm today to meet with our estate planning lawyer to make sure the person making decisions for you during your incapacity is the correct person.