Plan for the future with Legacy Law Firm,

Your Estate Plan is a

Legacy of Love

You've spent your life building something you're proud of and caring for the ones that you love, don’t undo your legacy by not having an estate plan.

Unsure where to begin with estate planning? We can help with that. Estate planning doesn’t need to feel intimidating, uncomfortable, or complex. Legacy Law Firm will lead you through the entire process, from start to finish and create the best plan for you and your family.

We can’t remind clients enough that the North Carolina estate planning process involves much more than drafting your last will and testament. Whether you are a young new parent or reaching retirement age, it is important to plan for all aspects of your future before and after you pass away.

At its core, estate planning is about establishing not only who will receive your assets, but also who will manage your business, manage your finances, care for your children, or make medical decisions in the event of your incapacitation.

What Are the Goals of Estate Planning?

Define your wishes regarding end-of-life treatment or other critical medical decisions

Ensure care for a spouse, significant other, or domestic partner after your death

Determine who will raise your minor children

Determine who will take care of your finances if you are unable.

Reduce or, in some cases, eliminate probate and inheritance related expenses

Protect your assets for your heirs

Distribute your property per your wishes, not the state’s

Provide for a special needs child, an elderly parent, or another beneficiary who would benefit from a trust structured to meet their needs for life

What Makes An Estate Plan Effective?

Many presume that a will is all you need to convey your wishes for your estate. Unfortunately, if you just have a will, you have only addressed what will happen to your estate after you pass.

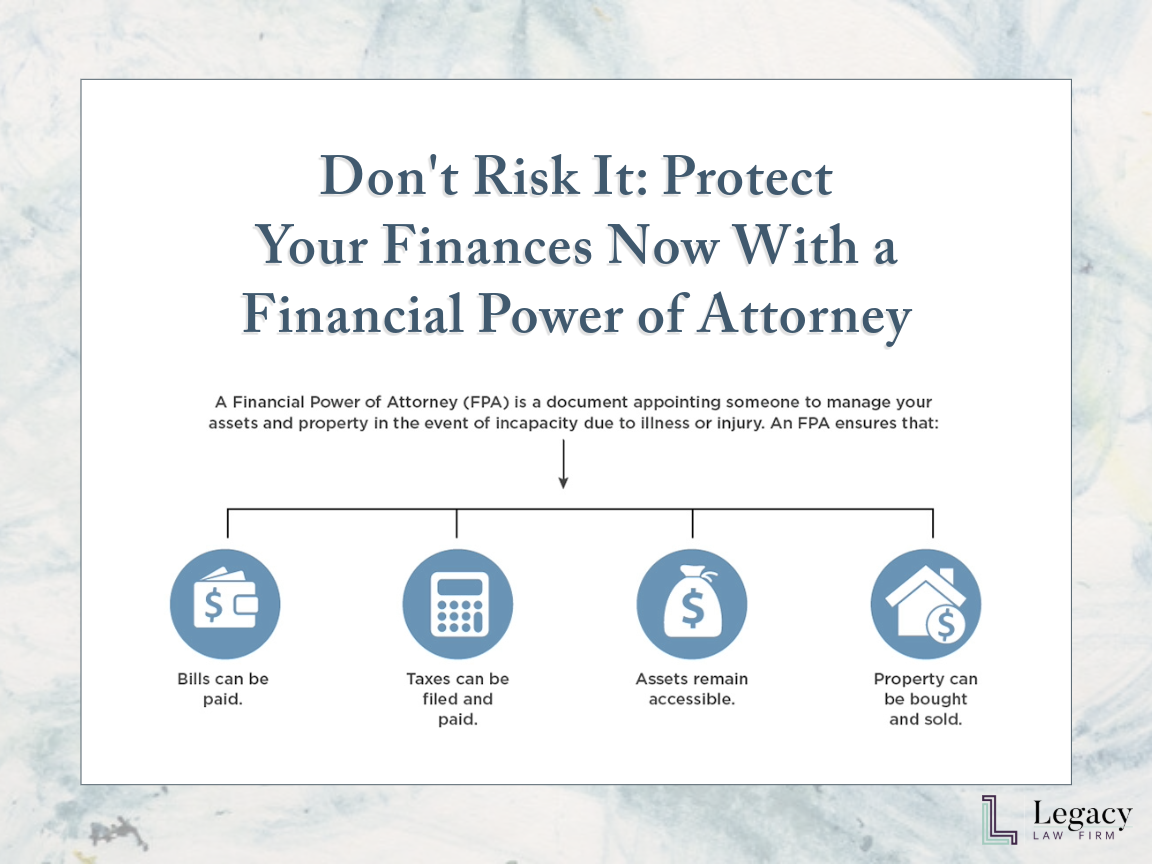

What about your estate while you are living? If you become incapacitated and do not have a Durable Power of Attorney and Health Care Power of Attorney, the court will appoint a guardian of its choosing to manage your assets and make healthcare decisions on your behalf. Those decisions may not align with your values and wishes.

To ensure that your estate plan effectively addresses your wishes, both while you are living and after you pass, at a minimum, your estate plan should consist of the following five foundational estate planning documents:

Last Will & Testament

Health Care Power of Attorney

Living Will (Advanced Directive)

HIPPA Release

Depending on your circumstances, your estate plan may also include more advanced planning tools such as one or more trusts, deeds, business entities, nominations of guardian for minor children, or Medicaid planning. After we meet with you and learn about your life, we can advise you as to whether any advanced planning tools are necessary to protect your assets and care for your loved ones.

By speaking to an experienced estate planning attorney, you can also avoid unintended consequences from a DIY estate plan.

Plan for the future now with Legacy Law Firm

We know that there are few things as intimidating as the task of completing your estate plan. However, the best time to plan for your incapacity or passing, is while you’re still healthy. By making these plans now, you can reduce the stress that your loved ones encounter when you become ill or pass away.

Contact Legacy Law Firm today to ensure you have a comprehensive tailored estate plan that reflects your values and wishes today.

The Estate Planning Process

-

Our Consultation

In this meeting (in-office, in-home, or virtual), we will learn about you, your family, your assets, and what you’d like to accomplish. If you are unsure of your goals, we will gladly help you clarify them. By the end of the consultation, we will make a recommendation as to the best estate plan to meet your goals and work together to collect the initial information required to draft your plan. We will also provide you with a flat fee quote for your customized North Carolina estate plan.

-

Document Drafting

After the consultation, there will be an initial information-gathering period, which may include follow-up phone calls or a second meeting to go over additional questions or changes to your plan. Once we are on the same page about what your estate plan should look like, we will prepare drafts of your final estate planning documents. We will send you a confirmation email to make sure everything reflects your intentions and make any necessary revisions.

-

Signing Conference

Once the drafts are finalized, we'll schedule a signing conference to do a final review of your plan before signing to ensure it reflects your preferences. If we are meeting in-office or in-home, we’ll bring a notary and coordinate witnesses. If we are collaborating remotely, we’ll mail your documents and assist with arranging for witnesses and notary services. Once your documents are executed, we’ll ensure that you have the original copies as well as electronic copies.

FAQs

-

We charge a $250 consultation fee. We often spend a few hours preparing for the consultation and provide legal advice during the consultation. The consultation fee covers the time expended and the legal advice you receive.

-

To make things simple and affordable, I use flat-fee pricing. The fee for your estate plan depends on the documents we will be preparing as well as whether we need to draft special provisions. You’ll walk out of the consultation with the final fee quote for your customized estate plan.

-

Our goal is to have your estate plan completed within a month of our initial consultation. To stay on schedule, once you decide to move forward, we’ll reserve tentative times for the document review and signing conferences. In emergency situations, we can often accommodate an expedited timeline.

-

We can do everything remotely! For our consultation and subsequent meetings, we can meet via Facetime, other video conferencing platforms, or via telephone call. I can securely email you a draft of your estate plan for review. For the final signing conference, I’ll mail you a binder containing your documents and assist with arranging for witnesses and notary services. All that is required is that you reside in North Carolina.

-

For all of our meetings, I will bring everything that we need, including my own internet. For the final signing conference, I’ll bring a printed copy of your estate plan for signature. I also pack a small printer in my car in case we need to make on the spot revisions. I am a notary, so all we need for the signing conference are two witnesses. If you have witnesses available, that’s great. If not, I’ll coordinate bringing or finding witnesses.

-

Absolutely! When we say we’ll come to you, that means we come wherever you need us, whether it be a hospital, an assisted living facility, your office, or other location where we can speak privately.

-

For anything within a 20-minute drive of my office (Gastonia, NC) or my house (Dallas, NC), the only additional fee is a mileage reimbursement. For anything outside of this radius, we can discuss the travel fee, which will vary depending on the distance.

-

Your estate assets consist of everything you own: your home, your personal property, bank accounts, retirement accounts, business holdings, investment accounts, etc.

I’m a firm believer in approaching estate planning with intentionality. A great estate planning attorney should always act with a client’s goals in mind and design their estate plan only after learning about the client as a whole.

I want to hear about your friends that are like family, the picture your young child drew in school last week, the pets you want to care for in your will, and your path in life. Getting to know you is as important in the estate planning process as knowing just numbers and facts about your assets.

Contact Legacy Law Firm today and allow us to collaborate with you on an estate plan designed with your life story in mind.